Tax Benefits for Donors (Japanese taxpayers)

Donations to Nagaoka University of Technology are eligible for tax deductions. The receipt for tax deduction will be sent to donors whose address is in Japan.

For Individuals

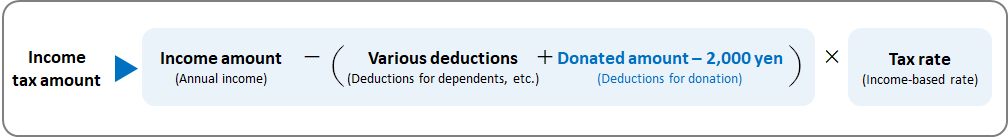

Income tax deductions

The deductible amount is calculated according to the tax rate multiplied by the donated amount.

For donations exceeding 2,000 yen, the donated amount minus 2,000 yen can be deducted from that year’s income. However, this is limited to an amount that does not exceed 40% of the donor’s gross income.

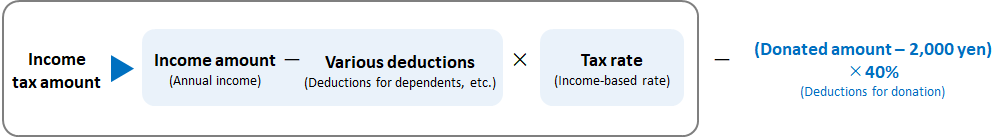

Tax credit

A certain percentage of the donated amount is directly deducted from the income tax amount, regardless of the income tax rate.

This system allows a certain percentage of the donated amount to be directly deducted from the income tax, irrespective of the individual’s income tax rate. As a result, for many people, the tax reduction effect is greater compared to income deductions.

※ To receive this tax incentive, please include your donation receipt and a copy of the "Certificate for Tax Credit" when filing your tax return at the tax office. The "Certificate for Tax Credit" will be sent to you along with the donation receipt.

For Companies and Organizations

The entire donated amount is tax deductible.